Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

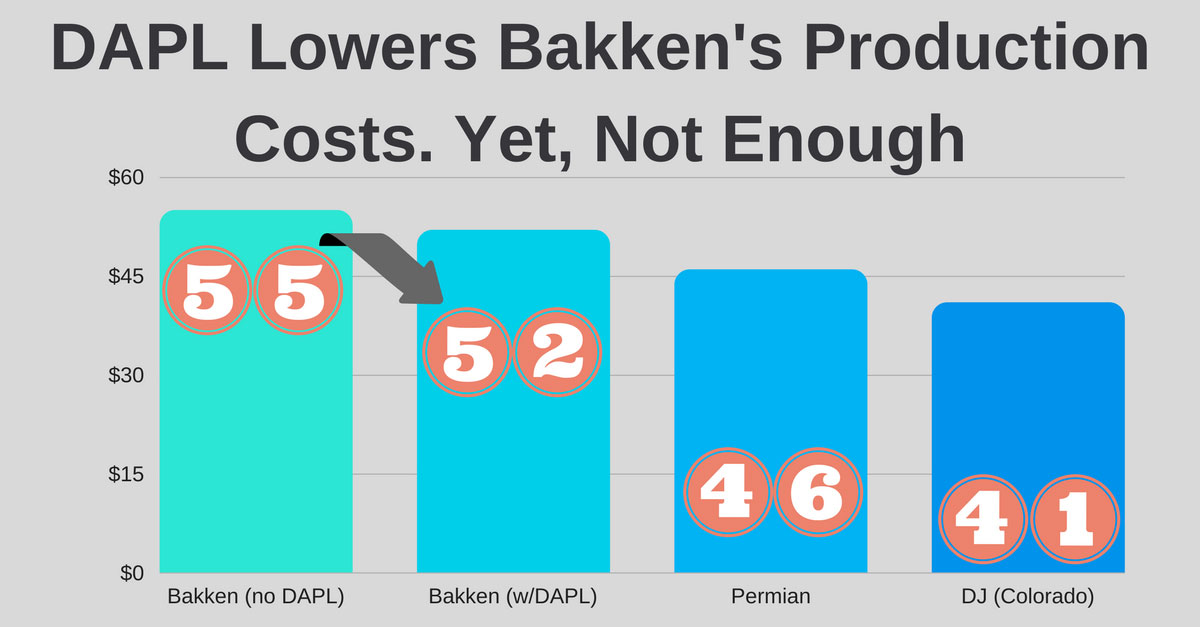

Bakken After DAPL Is in Operation: Still Hard to Compete

10/27/2017

North Dakota’s Bakken shale play will remain at certian disadvantage against Texas and Oklahoma even after the DAPL pipeline is in full service.

The break-even cost drilling cost for the basin is estimated to drop to $52 a barrel from $55 due to shift away from rail transportation to the DAPL. However, that compares with about $46 on average in Texas’s Permian play and $41 in Colorado’s DJ basin.

The 1,172-mile (1,886-kilometer) pipeline is designed to ship as much as 570,000 barrels of crude.

Bakken was named for Henry Bakken, a North Dakota farmer whose land hosted the first well in the region in the early 1950s,

It is expected to produce an average of 1.1 million barrels a day of oil this year and next, a figure lower than the 1.2 million barrels produced in 2015, according to the Energy Information Administration.

At the same time, Permian production is expected to reach 2.9 million barrels a day by the end of next year, the EIA said in July.

Bakken activities are easy to trace and examine with a complete and up-to date oil and gas information from well activity to processing and exporting on our Bakken Infrastructure Map.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Chevron Acquires Hess in $53 Billion Oil Megadeal Following Exxon's Pioneer Purchase

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/199Blog_Chevron to Acquire Hess for 53 Billion.png)

Chevron Corp has agreed to acquire Hess Corp in a $53 billion all-stock deal. This acquisition will not only enhance Chevron’s position in the domestic oil market but also fetch a substantial stake in Exxon Mobil's promising Guyana projects.

Multi-Billion Dollar Deal: Ovintiv to Expand Midland Basin Portfolio with EnCap Acquisition and Exit Bakken

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/145Blog_New Ovintivs Permian Basin inventory.png)

Ovintiv Strikes Billion-Dollar Oil Deal, Doubling Production in Permian Basin with EnCap's Black Swan, PetroLegacy, and Piedra Resources. The deal, which was approved unanimously by Ovintiv's board, is slated to close on June 30. With over $5 billion in transactions announced on April 3, Ovintiv is set to expand its oil production by snatching up 65,000 net acres in the core of the Midland Basin. The deal with EnCap will give them a strategic edge in Martin and Andrews counties, Texas, with approximately 1,050 net, 10,000-ft well locations added to their inventory.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?