Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

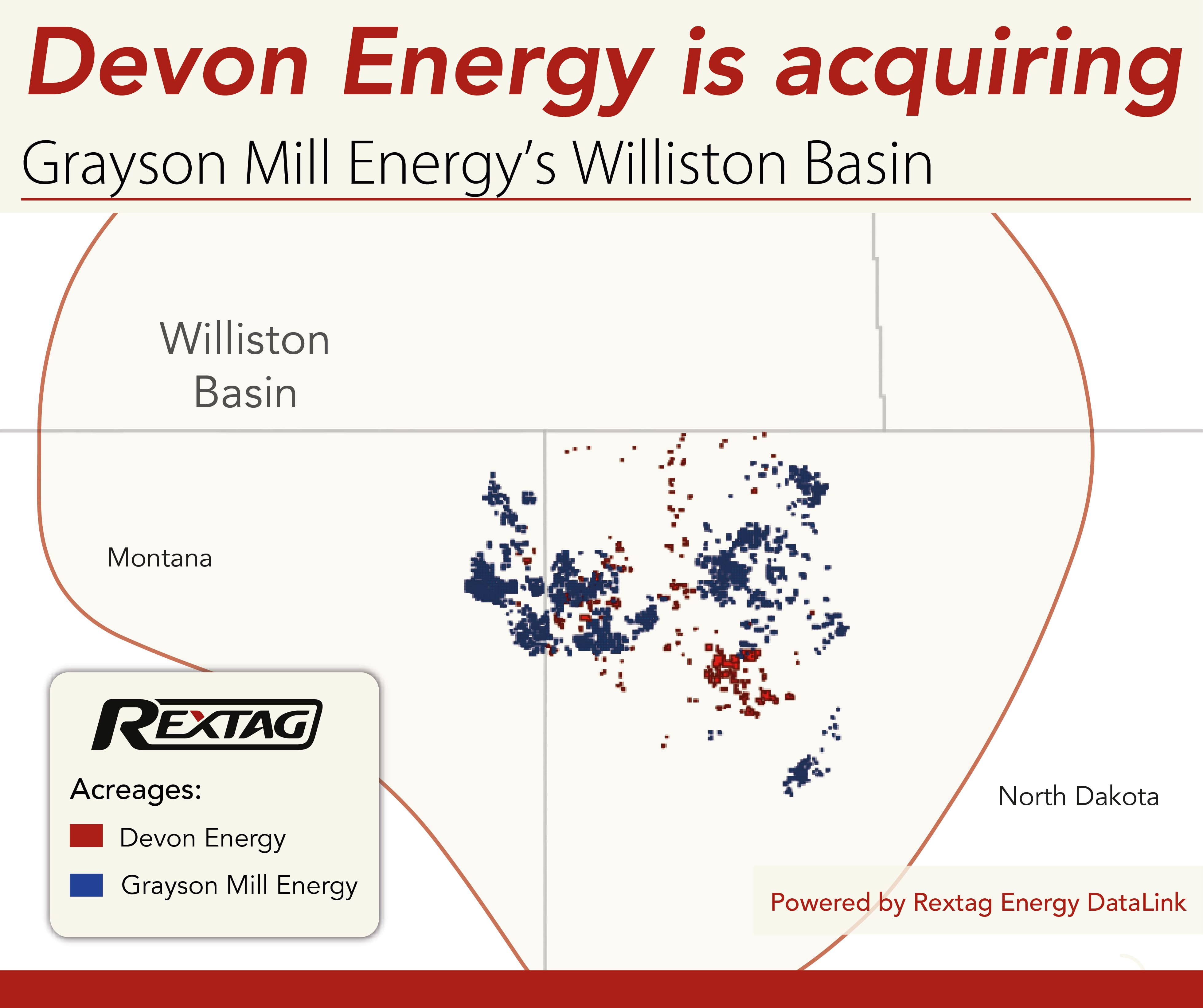

$5 Billion Grayson Mill Deal Expands Devon Energy's Williston Operations

Based in Oklahoma City, Devon Energy is expanding its operations in the Williston Basin with a major $5 billion acquisition of Grayson Mill Energy, a company supported by the Houston-based EnCap Investments LP. This deal includes $3.25 billion in cash and $1.75 billion in Devon stock. Announced before the markets opened on July 8, this strategic move aims to boost Devon's oil production and operational scale significantly

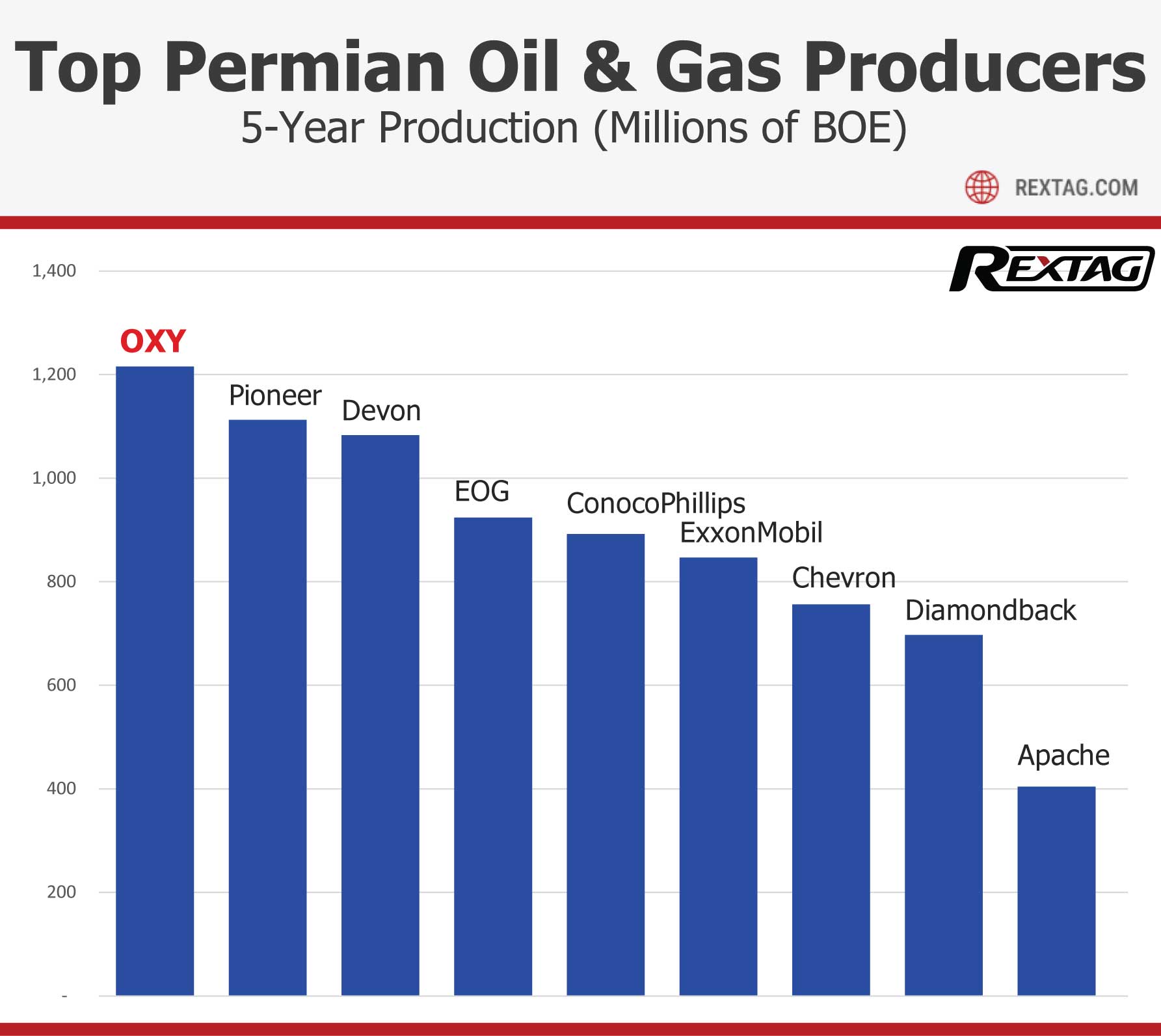

Top Permian Oil and Gas Producers: Five-Year Production

OXY has been the leader in Permian Basin production for the past five years. Currently, the Houston-based oil and gas company is deepening its presence in the basin with a $12 billion acquisition of CrownRock, adding over 94,000 acres in the Midland Basin and increasing its oil output by about 170,000 barrels per day. Occidental announced an increase in its proved reserves to 4.0 billion barrels of oil equivalent by the end of December 2023, up from 3.8 billion the previous year. Activities in the Permian largely fueled this rise. Occidental added approximately 303 million barrels through infill development projects as well as new discoveries and the further development of existing fields brought in another 153 million barrels.

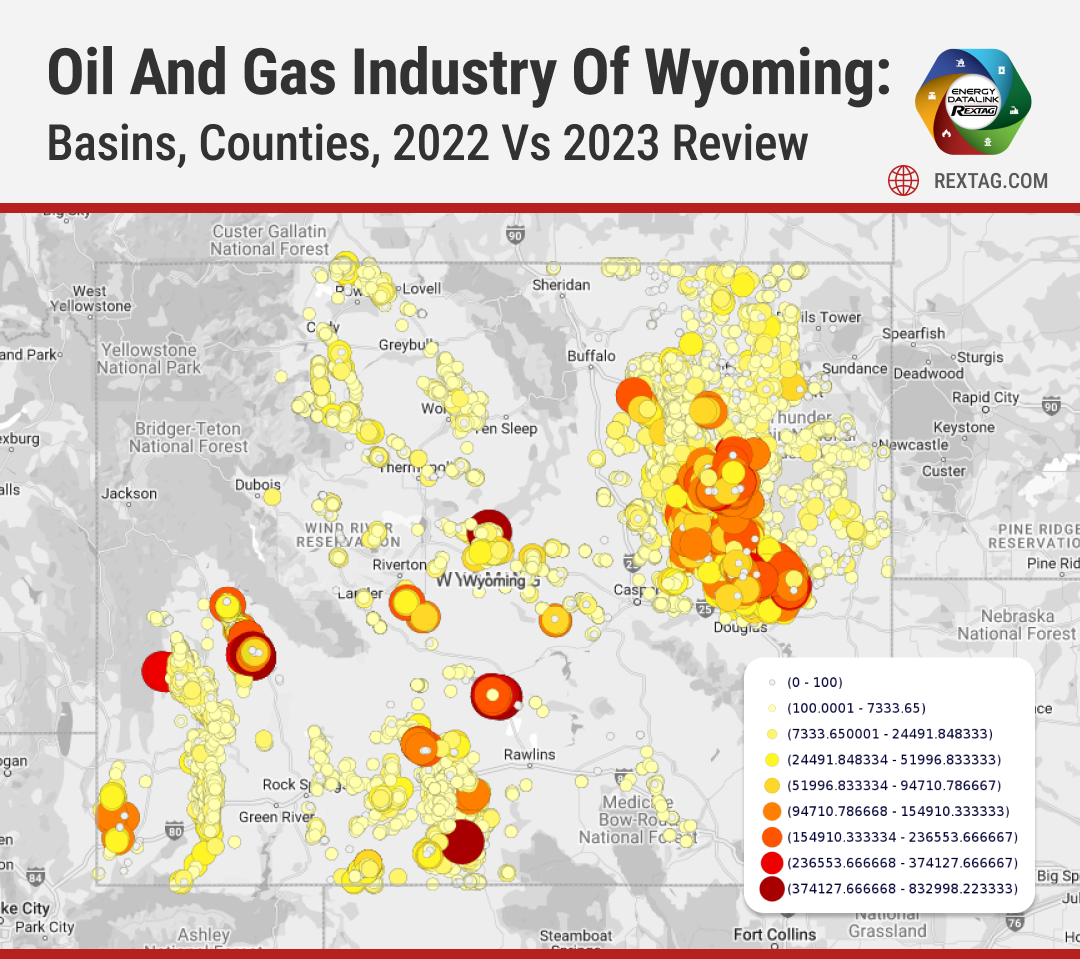

Oil and Gas Industry of Wyoming: Basins, Counties, 2022 vs 2023 Review

In Wyoming during 2023, the oil and gas industry experienced various trends and developments. Wyoming ranked 8th nationally in both crude oil and natural gas production, significantly contributing to the economy through property and severance taxes. The state had a peak of 27,951 producing wells in 2022, including oil and gas wells, with 33 operating gas plants processing nearly 97% of the state's gas production. Notably, 21 of Wyoming's 23 counties produce oil and/or natural gas, with Converse County leading in crude oil production and Sublette County in natural gas production. U.S. Energy Information Administration (EIA) predicted that crude oil production across the United States would increase to 12.8 million b/d in 2024. Throughout 2023, oil production in Wyoming showed an upward trend, with more than 95 million barrels expected to be produced, an increase of about 3 million barrels from 2022. This rise in oil production was partly attributed to the completion of 110 newly drilled oil wells in the first half of the year, mainly in the Powder River Basin. However, natural gas production faced a decline due to the aging of wells and a low number of new gas wells being completed. Only 18 new gas wells were finished in the first half of 2023, with a noted interest in drilling applications, suggesting potential future developments.

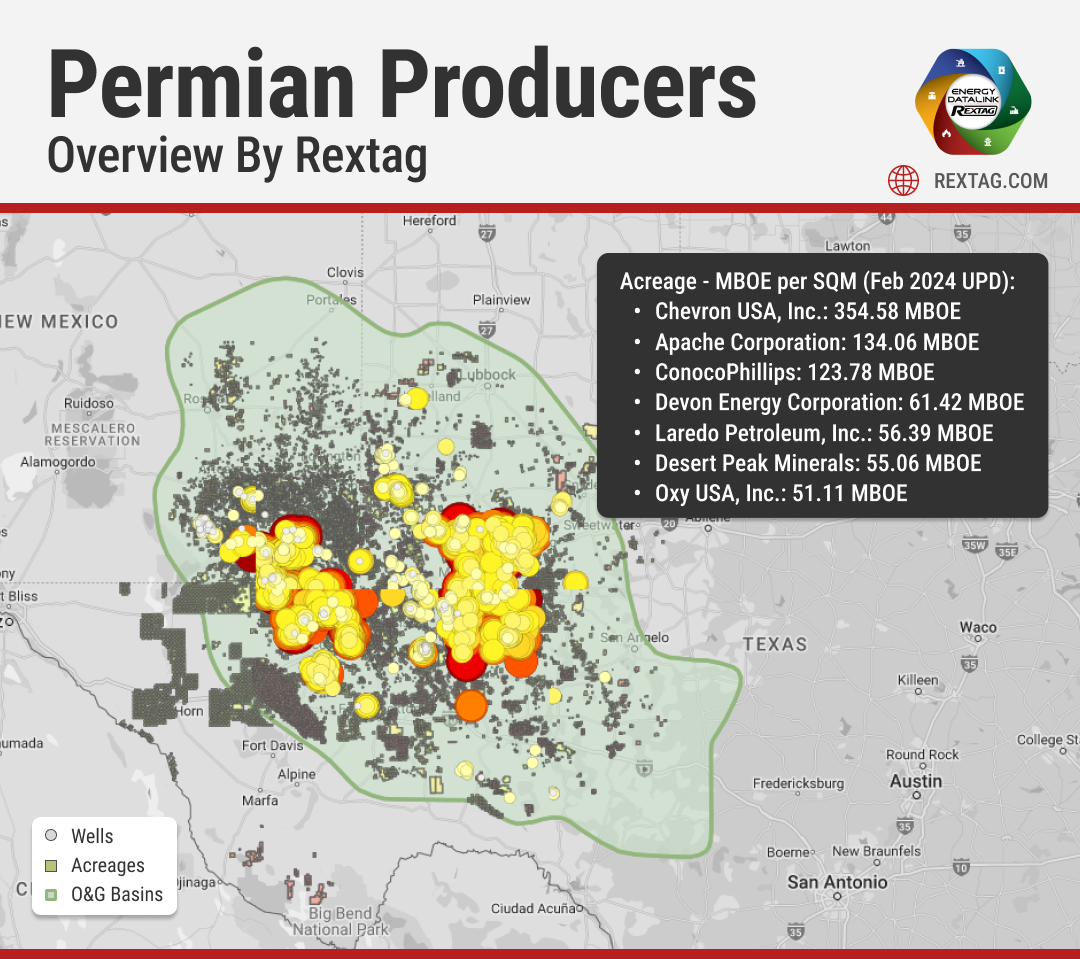

TOP 2022 vs 2023 Permian Producers Overview by Rextag

The Permian Basin, America's prime oil region, faced significant challenges during the COVID-19 pandemic. The industry saw a drastic reduction in rigs and fracking crews and had to close some operations as oil prices plummeted, leading to widespread restructuring. Now, the Permian is making a strong comeback. Over the last three years, exploration and production companies (E&Ps) have increased their drilling activities. They're focusing on spending wisely and maximizing returns to their investors. The Permian's role is crucial. It was projected to contribute over 5.98 million barrels of oil per day in December, making up about 62% of the total oil production in the Lower 48 states, as per the EIA.

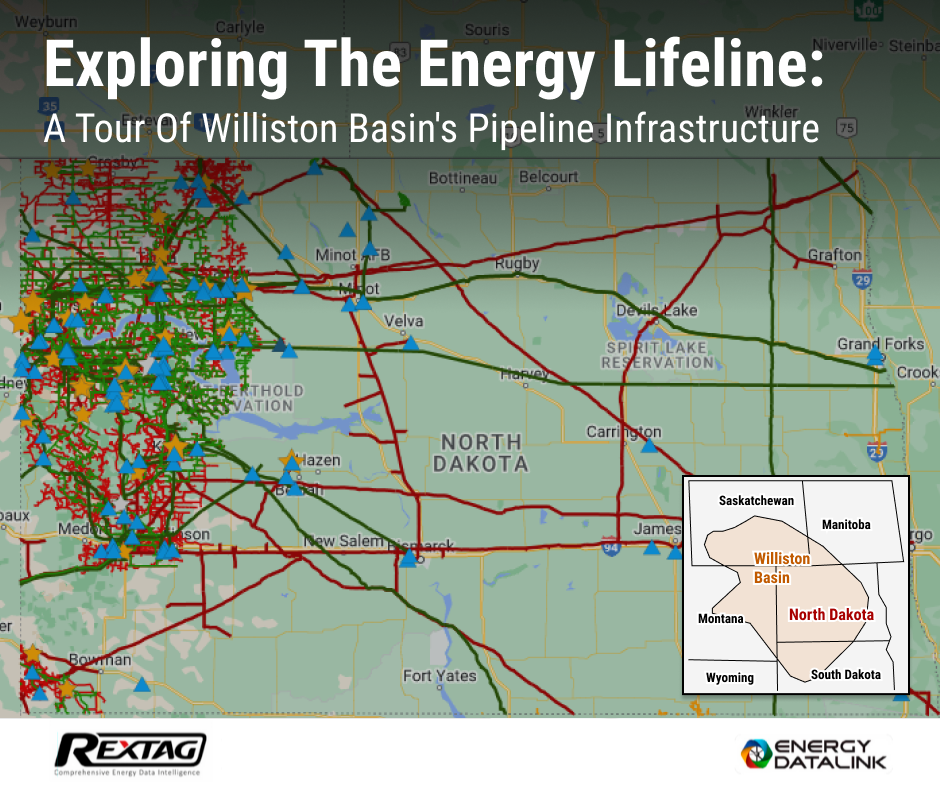

Exploring the Energy Lifeline: A Tour of Williston Basin's Midstream Infrastructure

The Williston Basin, which spans parts of North Dakota, Montana, Saskatchewan, and Manitoba, is a major oil-producing region in North America. In order to transport crude oil and natural gas from the wells to refineries and other destinations, a vast pipeline infrastructure has been built in the area. The pipeline infrastructure in the Williston Basin consists of a network of pipelines that connect production sites to processing facilities, storage tanks, and major pipeline hubs

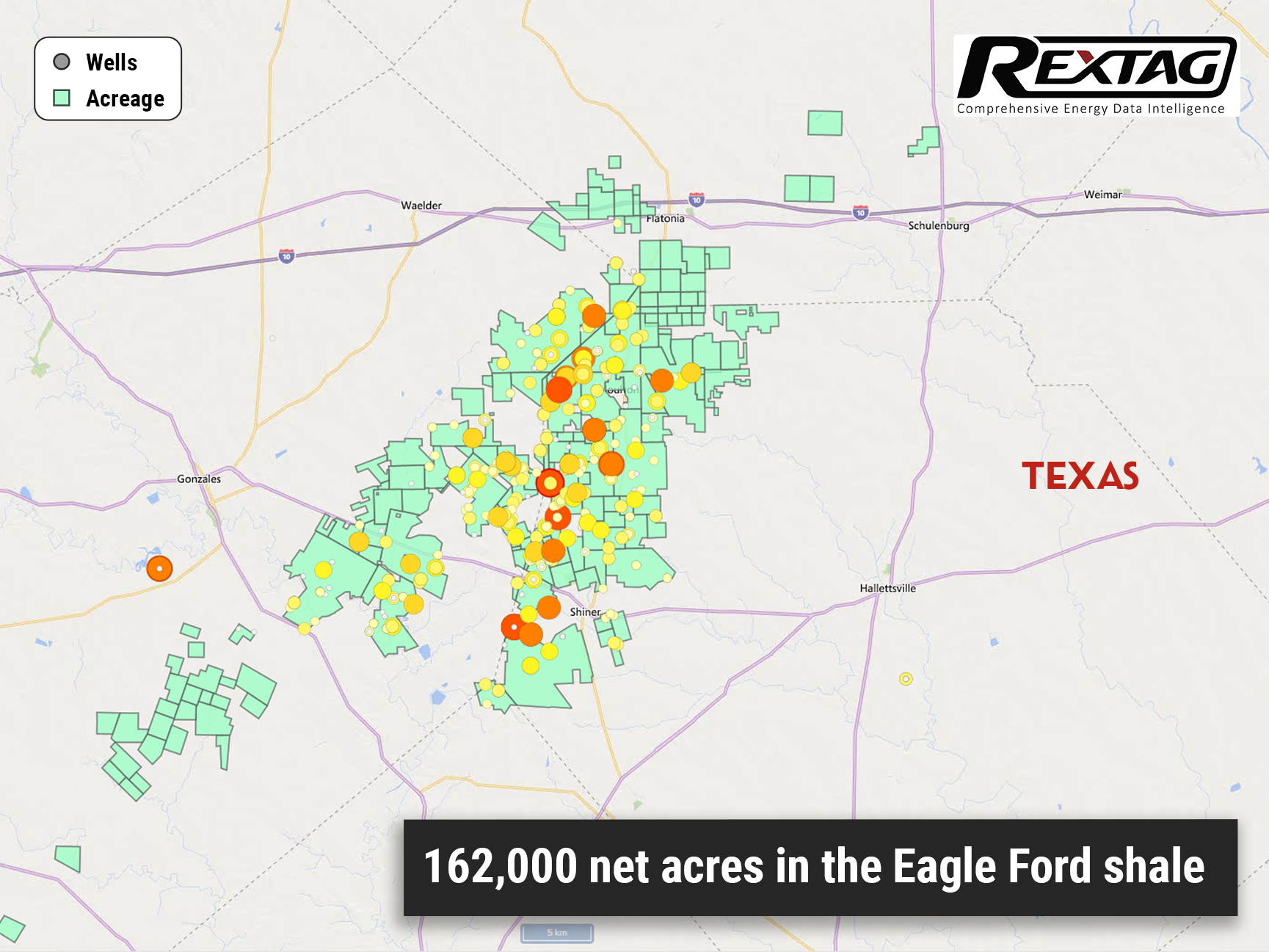

Energy Giant Baytex Makes a Bold Move: Snaps Up Ranger Oil in $2.5 Billion Deal

Baytex Energy Group has announced that it will acquire Eagle Ford exploration and production company, Ranger Oil, for approximately $2.5 billion in cash and stock, which includes taking over the company's existing debt. Upon the successful closure of the acquisition, Baytex will have a controlling stake of approximately 63% in the newly merged company, leaving Ranger shareholders with around 37%. This significant move is in line with a trend of substantial mergers and acquisitions in the Eagle Ford area, with Marathon Oil, Devon Energy, and Chesapeake Energy among the companies involved in recent transactions.

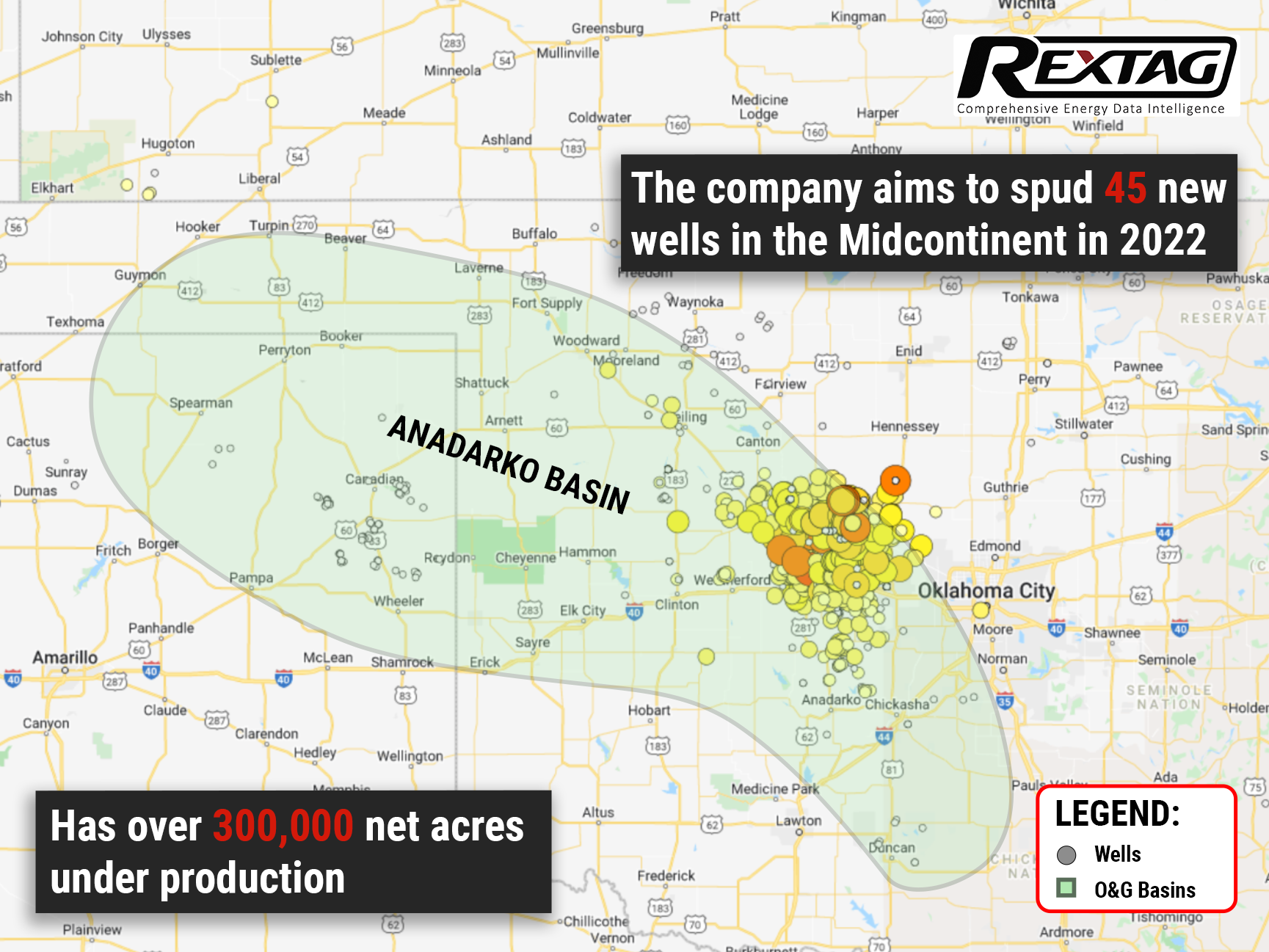

All In: Devon Energy is Banking on a Rebound for Anadarko

Devon Energy Corp. believes that the Anadarko Basin is a hidden treasure and aims to use its position in it to fuel a robust cash return model and establish itself as an industry leader in promoting ESG. This E&P company plans to drill 45 new wells in the Midcontinent by 2022, as well as to produce 600,000 boe/d across five operating basins, including the Eagle Ford Shale, Permian, Powder River, and Williston basins. And given that Devon's recent fourth-quarter results were better than Street estimates. It appears that they are doing something right, at least for the moment.