Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

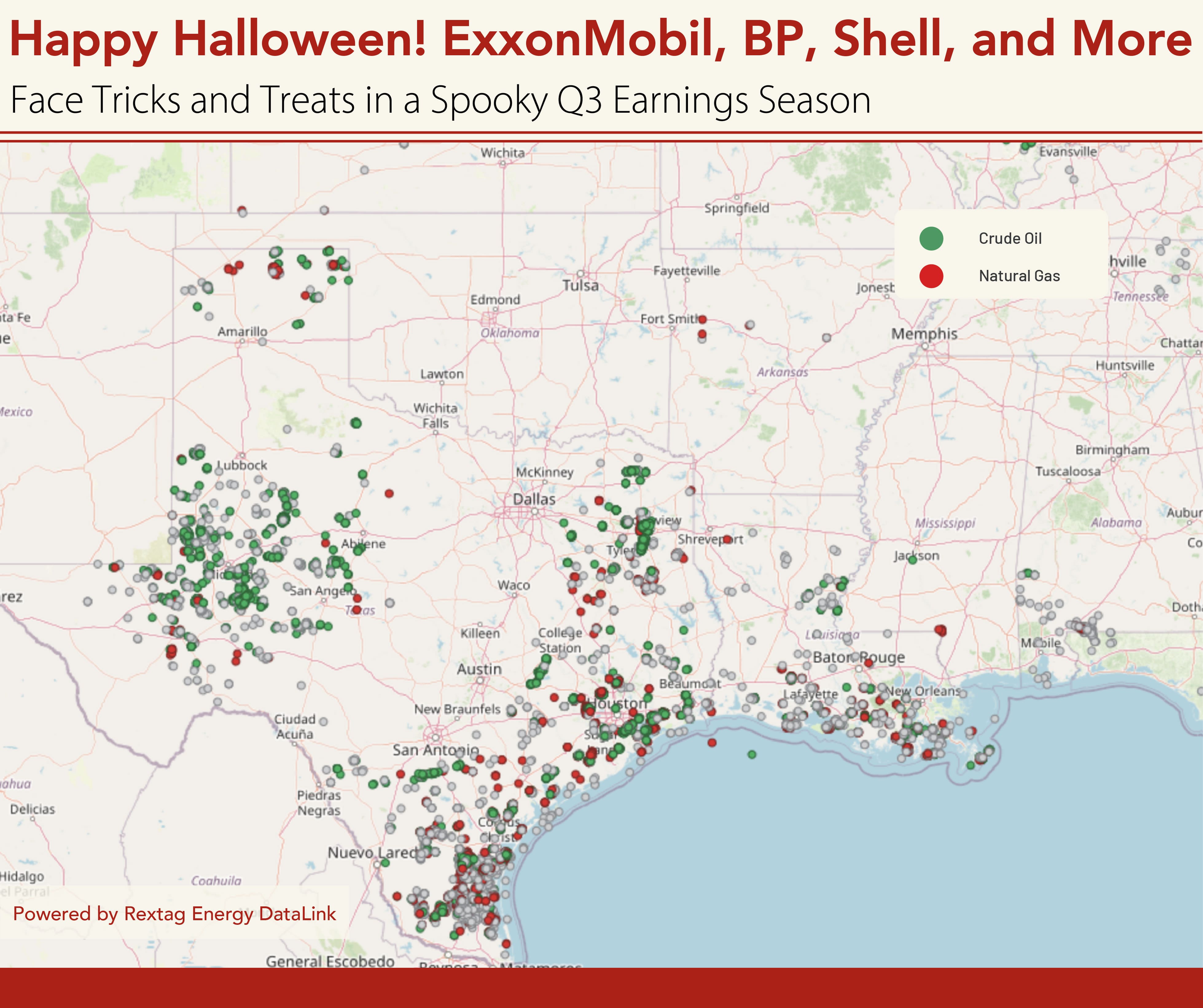

Happy Halloween! ExxonMobil, BP, Shell, and More Face Tricks and Treats in a Spooky Q3 Earnings Season

As the leaves fall and we settle into Halloween’s cozy, pumpkin-spiced vibes, it’s not just the ghostly shadows creeping through the energy sector; major oil companies have reported mixed Q3 earnings, facing various challenges and surprises. While some players faced profit slumps reminiscent of a seasonal scare, others found treats hidden among their strategies and diversified portfolios. Here’s a look at how ExxonMobil, BP, CNOOC, Phillips 66, TotalEnergies, ConocoPhillips, and Shell fared in the last quarter.

TOP 3 Must-Watch Trends in Oil & Gas: Exxon Mobil, Shell, BP and ConocoPhillips

Last week, Exxon Mobil, Shell, BP, and ConocoPhillips all reported second-quarter earnings that exceeded analysts' expectations, while Chevron’s results fell short, largely due to challenges in its refining business. A significant portion of these multi-billion dollar earnings came from oil and gas production. The companies' executives have indicated that they plan to increase spending on new exploration projects moving forward. While this doesn't suggest that investors are ignoring climate goals at these major oil firms, it does show that they are focusing more on the profits generated from production.

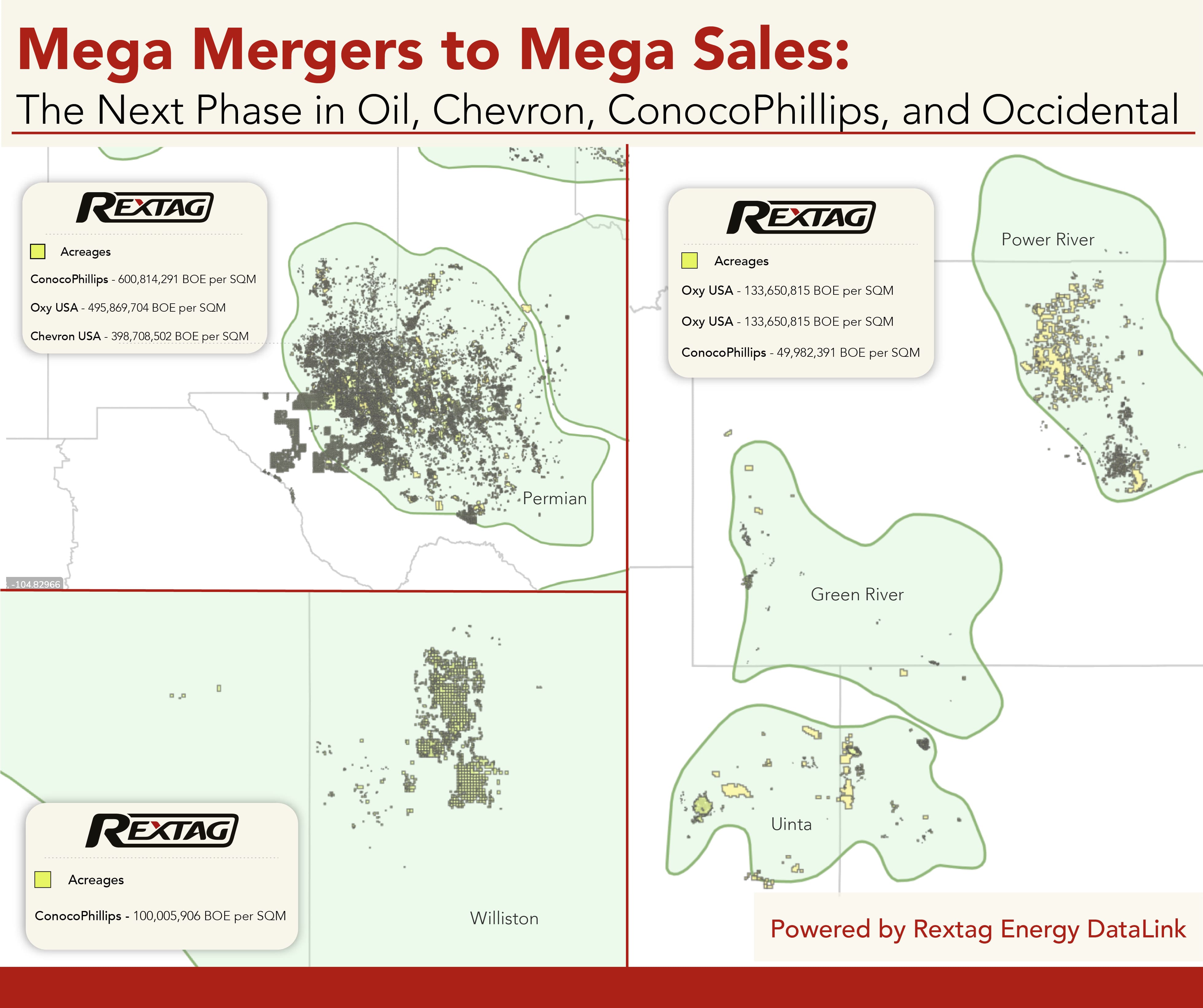

Mega Mergers to Mega Sales: The Next Phase in Oil, Chevron, ConocoPhillips, and Occidental

U.S. oil and gas companies are facing a tough task: unloading $27 billion in assets to pay their investors. This push comes as the largest wave of energy mergers in 25 years is about to clear its final regulatory checks. Chevron, ConocoPhillips, and Occidental Petroleum are aiming to raise between $16 billion and $23 billion from selling off assets after their mergers. Exxon Mobil, another major player, has been raising about $4 billion a year from sales since 2021 but hasn't set a specific target for future divestitures.

Ovintiv, Occidental, BP, Marathon Oil, ConocoPhillips, TC ENERGY Q1 Results and Sale of $1 Billion Permian Assets

As TC Energy expands its gas network to support the growing demand from data centers, driven by AI, Occidental is considering selling assets in the Permian Basin potentially worth over $1 billion. Keep reading. But first, let’s take a look at the Q1 2024 results for big names like Occidental (OXY), Ovintiv, BP, Marathon Oil, ConocoPhillips, and TC Energy.

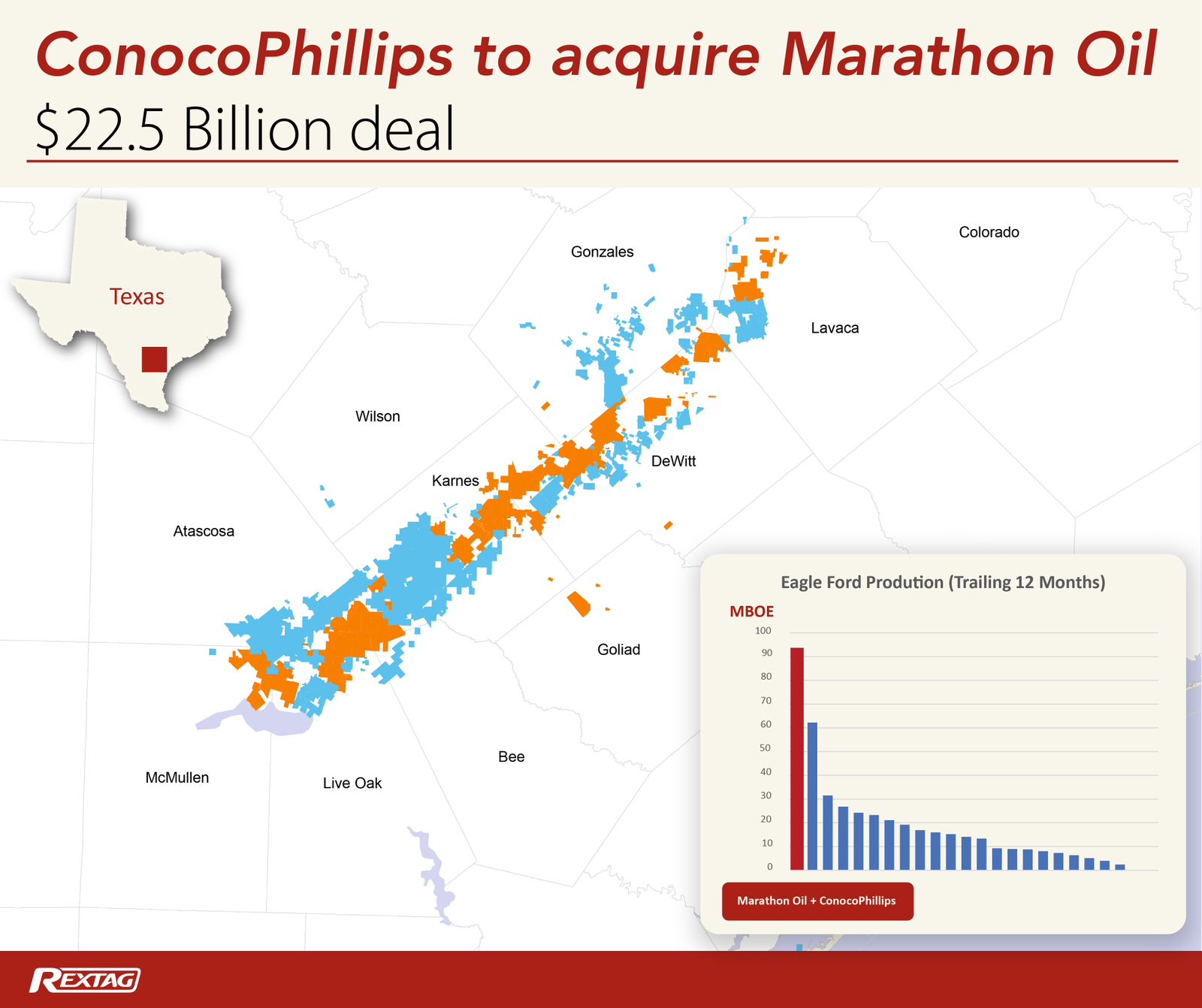

$22.5 Billion Shake-Up: ConocoPhillips Acquires Marathon Oil and Gains Major Influence in the Eagle Ford

The purchase of Marathon Oil adds 2,600 new drilling spots to ConocoPhillips' operations, boosting their total to over 13,000 across the U.S. After the deal, ConocoPhillips is set to significantly increase its production in the Eagle Ford region, potentially exceeding its current output in the Delaware basin.

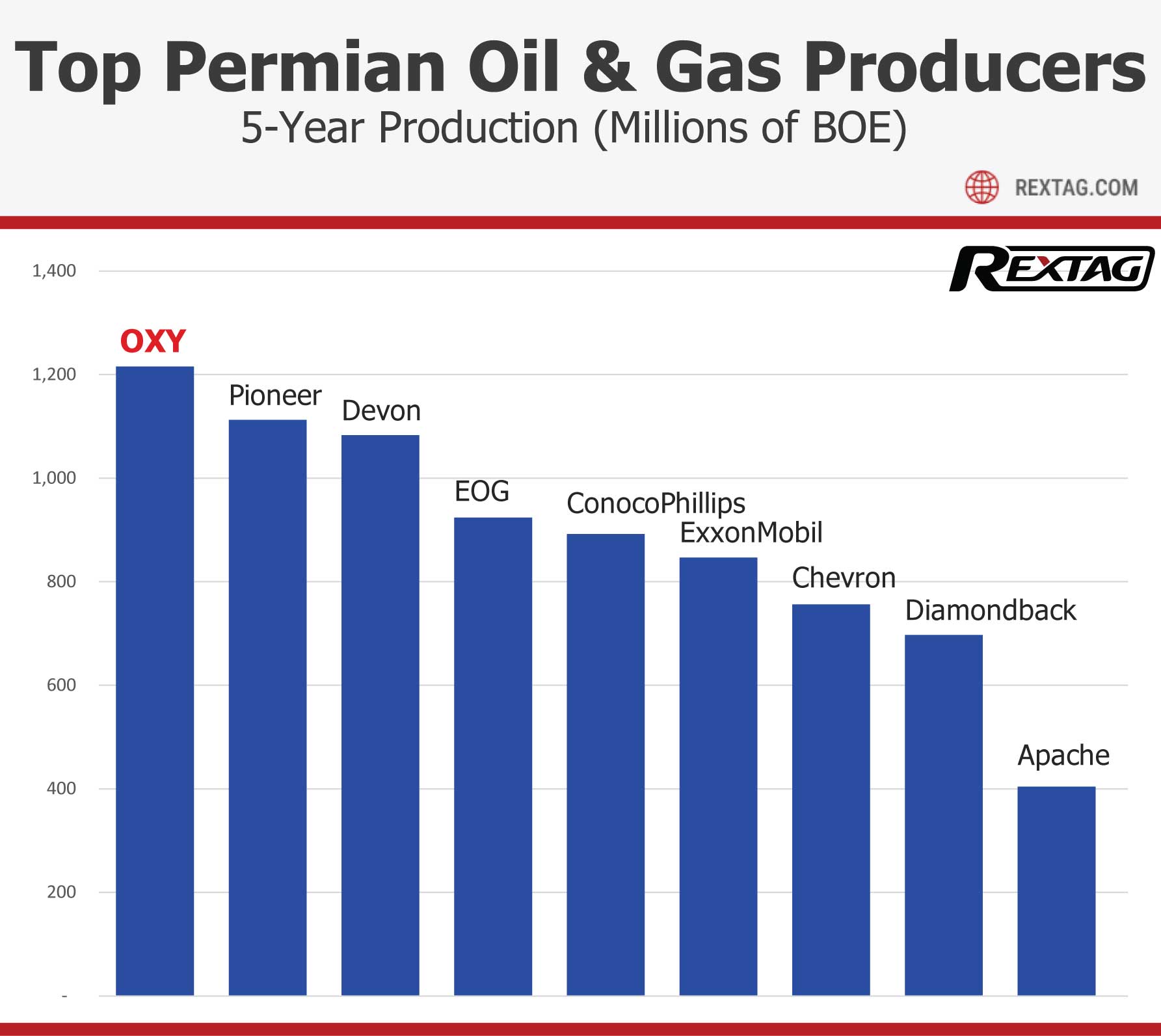

Top Permian Oil and Gas Producers: Five-Year Production

OXY has been the leader in Permian Basin production for the past five years. Currently, the Houston-based oil and gas company is deepening its presence in the basin with a $12 billion acquisition of CrownRock, adding over 94,000 acres in the Midland Basin and increasing its oil output by about 170,000 barrels per day. Occidental announced an increase in its proved reserves to 4.0 billion barrels of oil equivalent by the end of December 2023, up from 3.8 billion the previous year. Activities in the Permian largely fueled this rise. Occidental added approximately 303 million barrels through infill development projects as well as new discoveries and the further development of existing fields brought in another 153 million barrels.

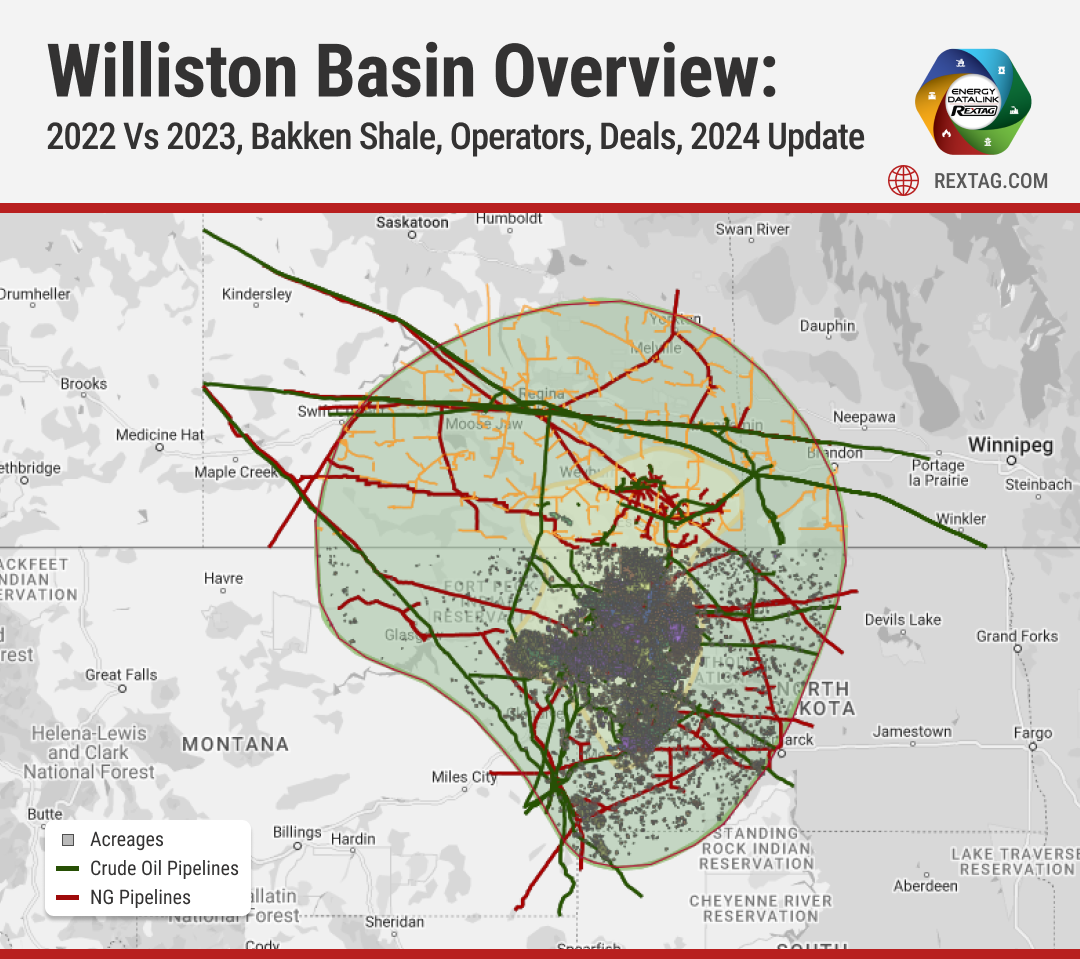

Williston Basin Overview: 2022 vs 2023, Bakken Shale, Operators, Deals, 2024 Update

The Williston Basin is a big area filled with layers of rock that sits next to the Rocky Mountains in western North Dakota, eastern Montana, and the southern part of Saskatchewan in Canada. This area covers roughly 110,000 square miles. Geologically, it's very similar to the Alberta Basin in Canada. People started drilling for oil in the Williston Basin back in 1936, and by 1954, most of the land where oil could likely be found was already claimed for drilling. The Bakken Formation with parts of Montana, North Dakota, Saskatchewan, and Manitoba has become one of only ten oil fields globally to yield over 1 million barrels per day (bpd) since the late 2000s. It is currently the third-largest U.S. shale oilfield, behind the Permian and Eagle Ford. The boom in the Bakken started around September 2008, coinciding with the U.S. housing market crash. The application of new technologies, such as swell packers enabling multiple-stage fracturing, significantly enhanced oil recovery, making the Bakken Formation a key player in the U.S. In 2022, the Bakken oil field saw big improvements in how much oil and gas it could produce. At the start of the year, 27 drilling rigs were working there, more than double the 11 rigs from the start of 2021. Important upgrades included making the Tioga Gas Plant able to process 150 million cubic feet more gas each day, and making the Dakota Access Pipeline bigger, increasing its oil transport capacity from 570,000 to 750,000 barrels every day.

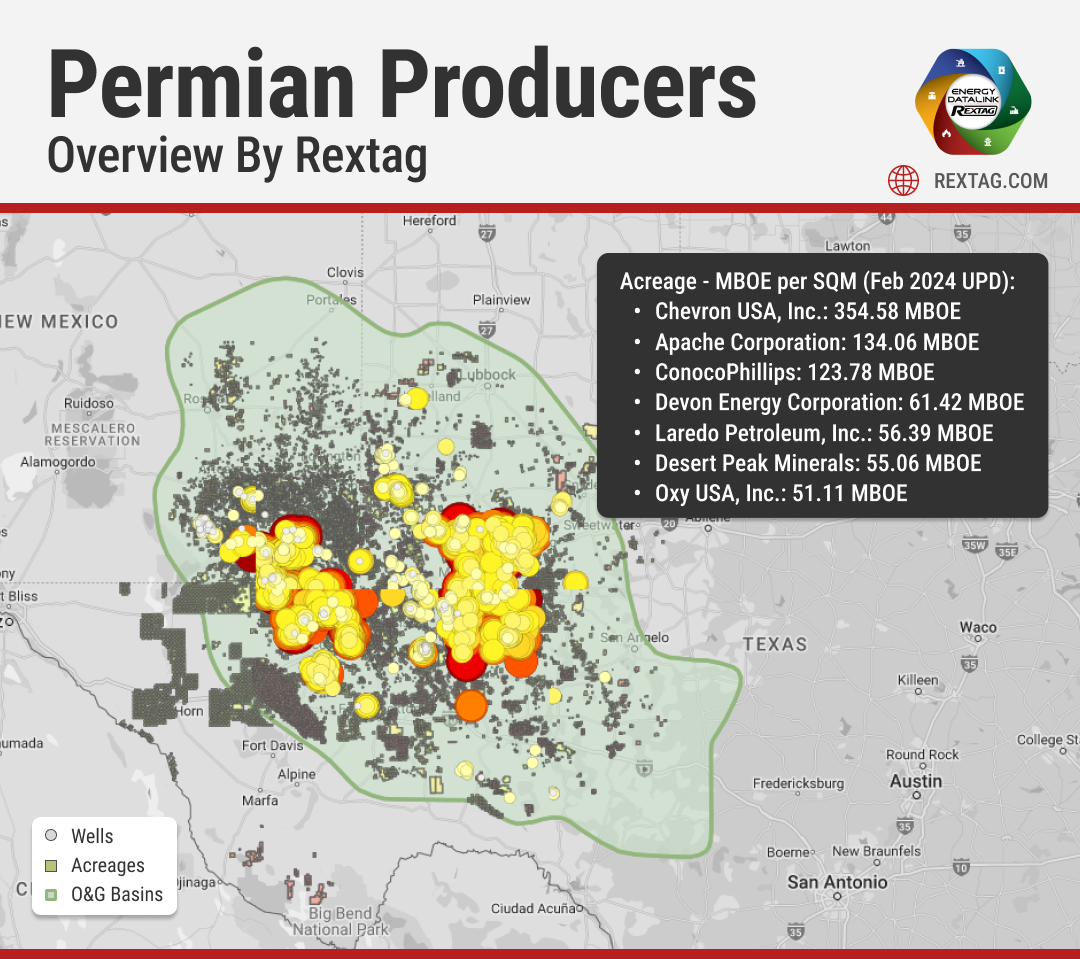

TOP 2022 vs 2023 Permian Producers Overview by Rextag

The Permian Basin, America's prime oil region, faced significant challenges during the COVID-19 pandemic. The industry saw a drastic reduction in rigs and fracking crews and had to close some operations as oil prices plummeted, leading to widespread restructuring. Now, the Permian is making a strong comeback. Over the last three years, exploration and production companies (E&Ps) have increased their drilling activities. They're focusing on spending wisely and maximizing returns to their investors. The Permian's role is crucial. It was projected to contribute over 5.98 million barrels of oil per day in December, making up about 62% of the total oil production in the Lower 48 states, as per the EIA.

Permian Basin Giants: 2024 Net Production Forecasts

Rystad Energy predicts that the merged company of Diamondback Energy and Endeavor Energy will produce 819,500 barrels of oil per day in the Permian Basin in 2024. Rystad, an energy research and business intelligence company from Norway, expects the ExxonMobil-Pioneer Natural Resources merger to lead the Permian in total net production for the year, with a projection of nearly 1.4 million barrels per day. Notably, about 53% of this production will be oil. Chevron is set to produce slightly more than Diamondback-Endeavor, with Occidental-CrownRock following closely. ConocoPhillips ranks fifth, with a production forecast of just under 800,000 barrels per day. Chevron's production is 47% oil, while Diamondback-Endeavor and ConocoPhillips have 57% oil in their mix, and Occidental-CrownRock is just below 50%.

Oil and Gas: Diamondback and Endeavor's $26 Billion Merger Redefines Permian Basin

Diamondback's buyout of Endeavor happened about four months after ExxonMobil and Chevron made huge deals, with Exxon buying Pioneer Natural Resources for $59 billion and Chevron getting Hess for $53 billion. Even though 2023 was a slow year for company buyouts and mergers, with the total deals at $3.2 trillion (the lowest since 2013 and 47% less than the $6 trillion peak in 2021), the energy sector was still active. Experts think this buzz in energy deals is because these companies made a lot of money in 2022.

Bakken's Tipping Point: Grayson Mill's Potential Fall After Chevron-Hess

The Permian Basin, a big oil area, is not seeing as many deals as before because lots of companies have already joined together. Now, experts think these companies might start looking for new places to invest in the U.S. One area getting attention is the Bakken play. Chevron Corp. has just made a big step there by buying Hess Corp. for $60 billion. Another company, Grayson Mill Energy, which got some help from a Houston investment firm EnCap Investments LP, might also be up for sale soon, worth about $5 billion.

Mexico Pacific LNG: A New Export Era Anchored by Permian Gas

Natural gas from the U.S. Permian Basin is set to be the primary source for Mexico's Pacific's Saguaro Energía LNG facility. Located in Puerto Libertad, Sonora, the Saguaro Energía LNG export facility will feature three processing trains. The site is primed for potential expansion with plans for three additional trains of similar capacity. Its strategic Pacific Coast location offers a 55% shorter shipping route to Asia, providing significant savings and reduced carbon emissions.

Streamlining ESG Management in Oil & Gas: Simplify Compliance with the Latest Standards

To effectively manage ESG issues in O&G companies, a comprehensive approach is required, addressing multiple managerial issues. First, ESG considerations must be integrated into the corporate strategy, setting goals that align with business objectives, reflected in budgeting, capital allocation, and risk management. Accurate and efficient collection, management, and reporting of ESG data is necessary for identifying relevant metrics and indicators, such as greenhouse gas emissions, water consumption, and social impact indicators.

Exploring ESG in Upstream Operations: Examining Achievements, Obstacles, and Emerging Patterns

ESG considerations are becoming increasingly essential for companies operating in the upstream sector. Failure to address ESG concerns may result in financial and reputational risks, given the growing focus from investors, regulators, and other stakeholders. Companies must prioritize ESG performance and engage with stakeholders to address concerns and mitigate risks. By doing so, they can improve their reputation, attract investment, and contribute to a more sustainable future

A&Ds in O&G forecast for 2023, trends and factors that influence this

“Our view is in 2023 M&A picks up. There was some this 2022 year, but again, it was such a funky, weird macro world. We expect fewer surprises in 2023.” — Dan Pickering, Pickering Energy Partners. Modern companies in the world operate in a rapidly changing external environment, so the process of reorganization is one of the basic tools for solving the problem of adapting companies to new conditions. Recently, the number of Acquisitions and Divestitures in the oil and gas industry has been growing rapidly, i.e. it can be said that the market for these deals is dynamically developing.

Blockchain as a technology for smart contracts in O&G

The oil and gas industry has long relied on the recommendations of trusted experts to make key supply chain decisions. The growing popularity of Blockchain technology could significantly disrupt these relationships by providing an unbiased methodology for sourcing, tracking, and executing transactions on behalf of customers with transparent data sets across supply chain endpoints. Blockchain technology has already been used by many global companies in the last two years in various areas such as IoT (Internet of Things), smart contracts, and cryptocurrencies. It has enabled businesses to benefit from the inherent trust and transparency of the technology.

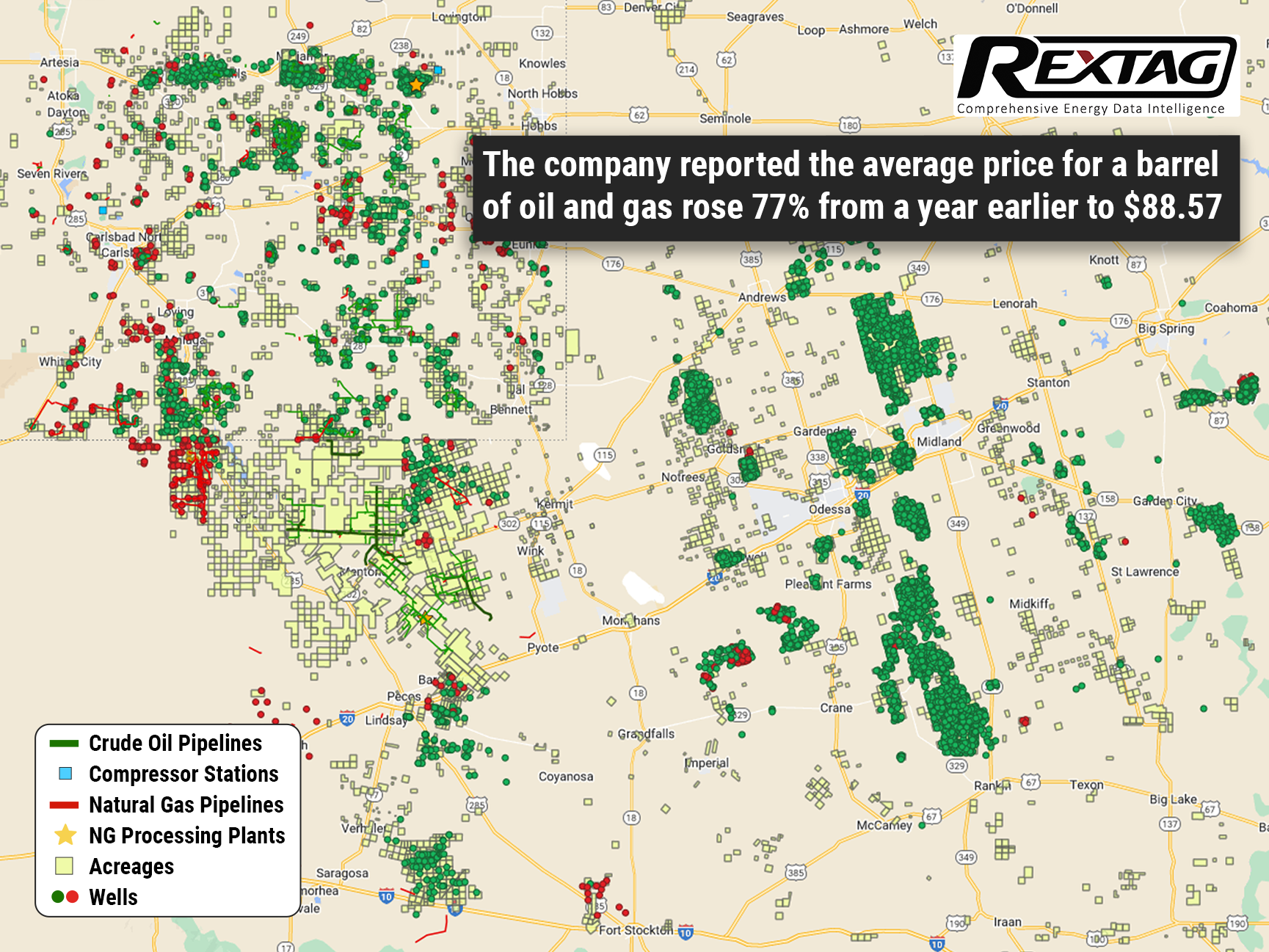

$5 Billion Returns for ConocoPhillips’ Shareholders as Prices Grow

Shareholder’s payout target was increased by 50% after the largest U.S. independent oil producer surpassed Wall Street’s earnings estimates on growing energy prices, said Houston-based Conoco Phillips Co. on Aug. 4. Due to Western sanctions on major producer Russia throttling energy supply amid a rebound in demand from pandemic lows, oil and gas #prices have soared. Crude has been trading more than 25% higher since the start of the year and results also benefited from high natural gas prices. Meanwhile, shares were down a fraction, to $91.03, in early trading but are up about 26% year to date. Conoco Phillips stated, that the average price obtained for a barrel of oil and gas accelerated 77% from a year earlier to $88.57. The company acknowledges that it has not hedged any of its oil and gas sales to make the most of higher market prices. The capacity of 1.69 million boe/d was in line with Wall Street estimates, however, the company expected the current quarter’s output would be between 1.71 million and 1.76 million boe/d.

Blog_Grayson Mill acquired Ovintiv's Bakken assets for $825M in 2024.png)