Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

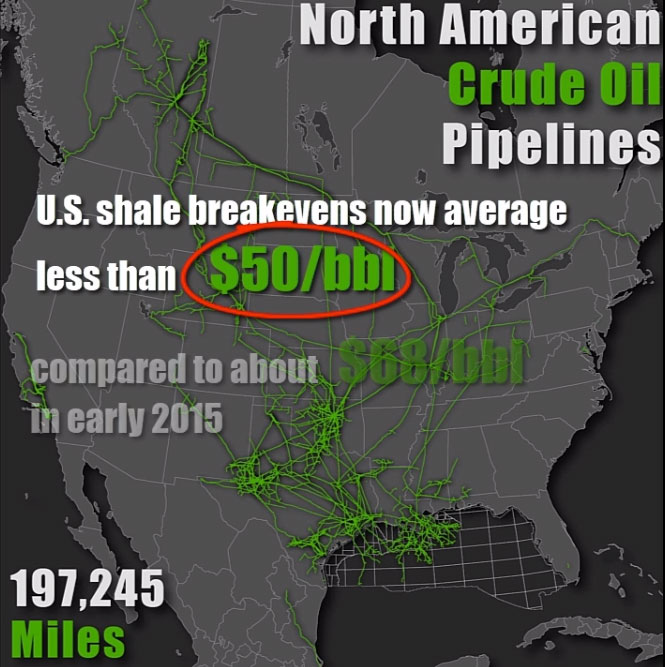

U.S. Crude Breakevens at Less Than $50/Bbl - Pipelines Help

03/04/2018

Oil and gas sector continues to restore its growth trajectory in 2018. Growing and more stable crude price outlook helps. However, this is not the only key to the industrial success.

OPEC remaining relevant a strong market player was influencing prices last year and will do so in 2018 as well. Its 30 million barrels share of the world market makes it a power to consider. They’re a big player and will continue to have a big influence on the market in years to come.

OPEC and Russia in their joint effort to cut production since end of 2017 succeeded and helped rebalance the market significantly. Production cuts by about 1.8 million barrels per day had an uptick effect on oil prices ever since. Oil prices—also aided by rising global demand—have steadily risen from the low $40s/bbl in 2016 to about $64/bbl in 2017.

U.S. shale breakevens now average less than $50/bbl, compared to about $68/bbl in early 2015, according to Deloitte.

This encouraging trend comes to view despite the inflationary trend which the industry has felt since the sector returned to growth in 2016. So, there must be some serious steps have taken to still be able to produce yet cheaper than before to overcome inflation.

Key reasons are TECHNOLOGY IMPROVEMENTS.

Essentially, DIGITAL SOLUTIONS is the success factor. usage of production data is, though still limited, becomes more systematic in nature. In upstream, producers have learned to differentiate the well-performing wells from the rest. Data on these field champions brings great insights about technology to apply to less successful areas. Thus, companies are using digital technologies to enhance their field development.

Additionally, SUPPLY CHAIN improvements help. Midstream companies having received significant investments prioir to the 2014-2016 price downturn times, still feel a significant debt burden. They are also slow to increase returns on investments made. All this has made midstream companies less attractive in the eyes of investors as oil prices began rebalancing.

This left transportation companies with no options left but improve their efficiency. Growing (even booming in Permian) Lower 48 production has put additional pressure on midstream operators. 2018 has become a year of significant disproportions between productiona dn takeway capacity in Permian.

In these difficult conditions midstream companies both increased their capacity and even faced the need to raise fees for the producers outside the contraced agreements. At the same time a number of companies expanded and boosted capacity of the existing pipelines to cope with the growing demand.

On average (not taking into account fluctuations due to capacity shortage), the Midland, TX to GoM oil price difference narrowed from formerly $30/bbl to just $3/bbl (!). All this is due to massive construction and expansion plans and new pipeline projects in Permian coming to operation in 2019 and especially in 2020-2022.

ASSET MAINTENANCE not just in upstream but also midstream, downstream and in the back office with robotic process automation is yet another success factor. use of IoT approach, focusing on maintenance data analysis allowed midstream companies to control their costs better.

According to Deloitte, the prize is sizeable for global oil and gas companies with the potential to save millions from their combined $2.4 trillion in operating costs.

U.S. is also expected to continue toward growth as an LNG exporter, already having strong refined product exports with gains in natural gas exports, particularly into Mexico.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Corpus Christi and its O&G Infrastructure

![$data['article']['post_image_alt']](https://images2.rextag.com/public/HEMDS_SiteSupportFiles/BlogImages/Corp_Christi_LNG_Map.png)

Export Opportunities For Permian’s and Takeaway Problem

Delays Are Finally Over: Enbridge Reports Strong Third Quarter 2021

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/Enbridge-Reports-Strong-Third-Quarter-2021.png)

Enbridge Inc. finally delivered on several of its long-overdue promises, including the $4 billion Line3 Replacement project. Which consisted of replacing an existing 34-inch pipe with a new 36-inch one for 13 miles in North Dakota, 337 miles in Minnesota, and 14 miles in Wisconsin. Midstream companies, in general, had a stunning Q3. It was the first quarter in two years that no midstream index members cut their dividends.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?