Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

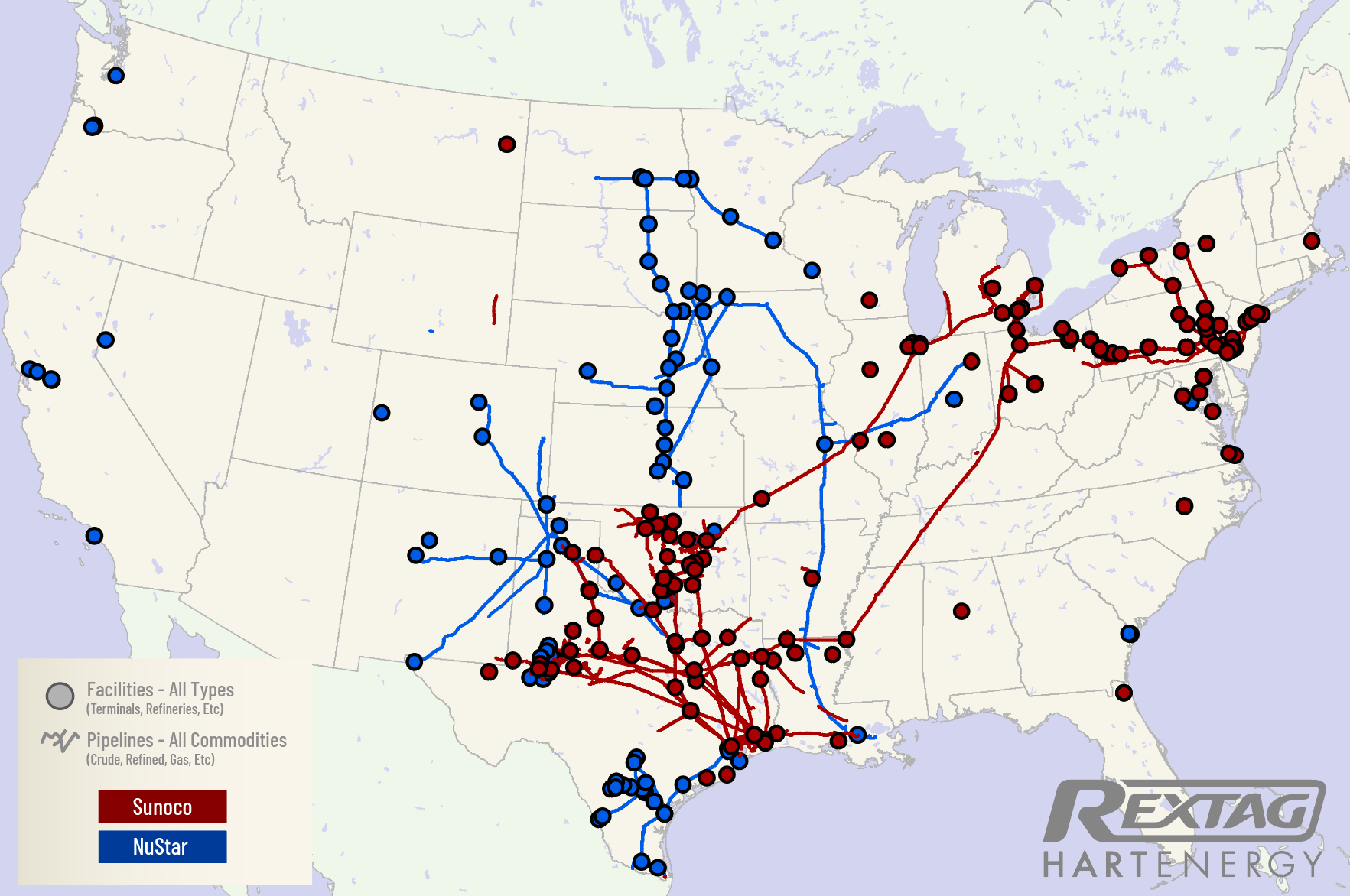

Dallas-Based Sunoco Buys NuStar Energy for $7.3 Billion

01/24/2024

Sunoco, a gas station company based in Dallas, will buy NuStar Energy, a major operator of liquid storage and pipelines, for $7.3 billion.

The acquisition of NuStar Energy by Sunoco not only enlarges Sunoco's fuel distribution business but also moves it into the crude oil middle market, especially in the important Permian Basin area.

Sunoco is part of Energy Transfer (ET.N), a major U.S. pipeline company controlled by billionaire Kelcy Warren.

Transaction Details

The deal to buy NuStar is worth about $7.3 billion, including debt. The deal's cash value is $2.99 billion. NuStar's shareholders will get 0.400 of a Sunoco share for each NuStar unit they own. This values Sunoco's shares at $23.78 each, a 31.9% premium over NuStar's last closing price.

“These are [crude] assets that make more sense with Energy Transfer. I think over time it will happen. These [NuStar] assets moving to Sunoco make a roll up make more sense.”

- Hinds Howard, portfolio manager at CBRE Investment Management

Energy Transfer tried to buy NuStar before, and using Sunoco units was probably the best way to complete the deal. Since NuStar has a big crude oil business, it seems likely that Energy Transfer will eventually combine Sunoco and NuStar, as part of the ongoing merging of similar companies (MLPs).

Given Energy Transfer's status as a large oil and gas company with the third-biggest market value among North American midstream businesses, this acquisition might attract extra attention from regulators.

Howard notes that with the trend of mergers and consolidations among Master Limited Partnerships (MLPs) in recent years, this deal reduces the number of significant MLPs in the industry to just 13. The merger brings together Sunoco and NuStar, which are the seventh and eighth-largest MLPs by market value.

“If you take a look at the combined assets of our organization, they’re very complementary in that there’s very little geographic or market overlap that you may typically see in mergers that have historically been of interest to the commission.”

- Scott Grischow, senior vice president of finance at Sunoco

Expectations

The companies anticipate saving $150 million by the third year after the deal closes, which is expected in the second quarter of 2024.

Analysts at J.P. Morgan commented that Sunoco's acquisition marks a significant change in strategy. They see it as a move towards becoming a more diversified and vertically integrated midstream company, especially noting the crude pipeline and storage assets Sunoco will acquire from NuStar.

Sunoco also plans to expand its fuel distribution in the western Midwest using NuStar's existing assets there, aiming to grow in an area where it currently has a smaller presence. In the previous year, Sunoco had purchased 16 refined product terminals from Zenith along the East Coast and Midwest for $110 million.

Given Energy Transfer's status as a large oil and gas company with the third-biggest market value among North American midstream businesses, this acquisition might attract extra attention from regulators.

Hinds Howard notes that with the trend of mergers and consolidations among Master Limited Partnerships (MLPs) in recent years, this deal reduces the number of significant MLPs in the industry to just 13. The merger brings together Sunoco and NuStar, which are the seventh and eighth-largest MLPs by market value.

NuStar's system in the Permian region currently moves around 540,000 barrels of crude oil per day. This helps transport oil to refining and export areas, including the Texas Gulf Coast and Louisiana. However, crude oil accounts for less than half of NuStar's total business.

NuStar operates roughly 9,500 miles of pipeline and 63 terminals and storage facilities. These handle various products such as crude oil, refined products, renewable fuels, ammonia, and specialty liquids. Altogether, their North American facilities have a storage capacity of 49 million barrels.

M&A Strategy

In 2021, Sunoco acquired NuStar's East Coast U.S. terminal assets for $250 million. According to Sunoco's COO Karl Fails, this allowed Sunoco to merge its East Coast fuel distribution with NuStar's stronger midstream presence in the region. Fails explained that having a fuel distribution business helps keep midstream assets busier, and midstream assets often lay the groundwork for further growth or supply synergies in fuel distribution.

After acquiring the East Coast assets, Sunoco launched a gasoline blending operation using NuStar's terminal in Linden, New Jersey, creating additional value for the merged business.

The NuStar acquisition not only increases Sunoco's scale but also introduces new business lines, such as crude oil pipelines, with NuStar operating about 2,100 miles of crude pipelines in Texas and Oklahoma. Additionally, the deal gives Sunoco around 2,000 miles of pipeline for transporting ammonia, marking another new venture for the partnership.

While these new segments are fresh additions to Sunoco's portfolio, they are connected to the refined products business, a sector Sunoco is already well-acquainted with, noted Grischow.

About Sunoco

Sunoco, based in Dallas and part of Energy Transfer, distributes motor fuel to around 10,000 places like convenience stores and businesses in over 40 U.S. states and territories. Sunoco, traded as SUN on the NYSE, also handles transporting and storing refined products.

Energy Transfer's connections to Sunoco are longstanding. The company acquired Sunoco in 2012 for $5.3 billion. Currently, Energy Transfer holds all the incentive distribution rights (IDRs) of Sunoco, although Sunoco continues to be traded independently on the stock market.

About NuStar Energy

NuStar Energy L.P., traded as NS on the NYSE, is an independent operator of liquid storage and pipelines. It owns around 9,500 miles of pipeline and 63 facilities for storing and distributing substances like crude oil, refined products, renewable fuels, ammonia, and specialty liquids. With a total storage capacity of about 49 million barrels, NuStar operates in both the United States and Mexico.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Occidental, CrownRock Merger Under Regulatory Review: 2024 Update

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/R 228 (Blog)- Occidental, CrownRock Merger Under Regulatory Review_ 2024 Update.png)

CrownRock's 94,000+ net acres acquisition complements Occidental's Midland Basin operations, valued at $12.0 billion. This expansion enhances Occidental's Midland Basin-scale and upgrades its Permian Basin portfolio with ready-to-develop, low-cost assets. The deal is set to add around 170 thousand barrels of oil equivalent per day in 2024, with high-margin, sustainable production.

Talos Energy Confirms $1.29 Billion Takeover of QuarterNorth Energy

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/224Blog_Talos Energy acquires QuarterNorth Energy for $1.29 billion.png)

Houston-based Talos Energy Inc. has made a deal to buy QuarterNorth Energy Inc. for $1.29 billion. QuarterNorth is a company that explores and produces oil in the Gulf of Mexico and owns parts of several big offshore fields. This purchase will add more high-quality deepwater assets to Talos's business, which are expected to bring steady production and new opportunities for growth. The deal should immediately benefit Talos's shareholders and help the company reduce its debt faster.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?