Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

Inconvenient Time for Canadian Crude: US Gulf Coast Is Glutted

06/14/2022

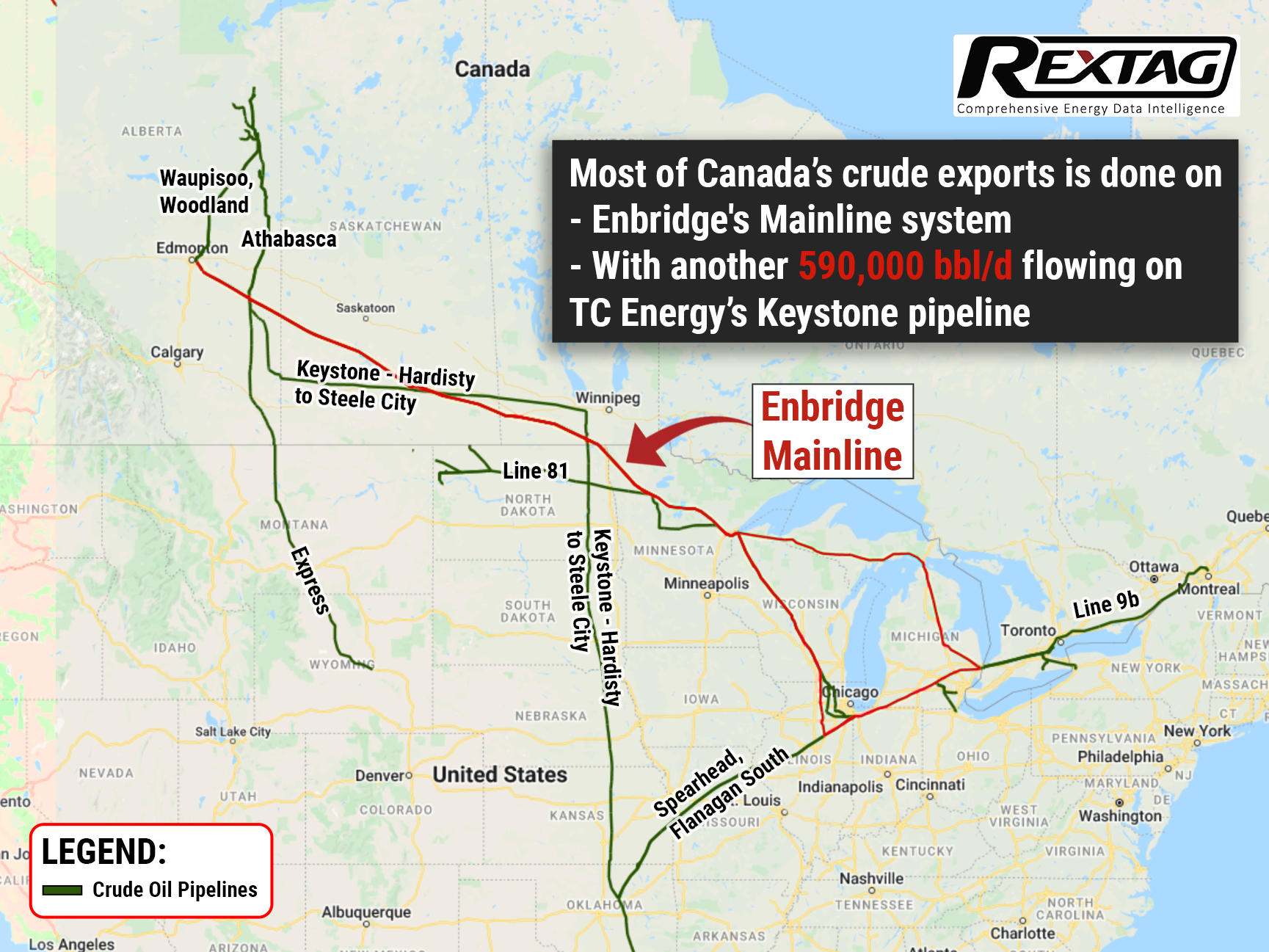

Canadian heavy crude, being deeply discounted for several years due to a lack of pipelines, is eventually trading like a “North American” grade, moving in tandem with U.S. sour crudes sold on the Gulf Coast thanks to Enbridge’s expansion of its Line 3 pipeline late last year.

Meanwhile, the Gulf is full of sour crude over Washington’s largest-ever release from the Strategic Petroleum Reserve (SPR) that will amount to 180 MMbbl during six months, trying to tame exorbitant fuel prices after the start of the conflict in Ukraine.

The market is flooded with millions of barrels of sour crude from storage caverns in Louisiana and Texas. At the world’s biggest heavy crude refining center, U.S. Gulf Coast, heavy grades like Mars and Poseidon are languishing.

The discount in July for Western Canada Select (WCS) delivery in the Hardisty crude hub reached more than $20 a barrel below the WTI benchmark last week, the widest since early 2020, as WCS sold more than 3,000 km (nearly 2,000 miles) away in Hardisty, Alberta, is getting dragged down with them.

However, the undermining of the sour Gulf surplus is expected to be a period of stronger WCS demand in Hardisty, as maintenance on oil sands projects decreases supply and as U.S. refineries exit turnarounds.

Some analysts suppose that other factors resulting in the WCS discount widening include the high price of natural gas, which escalates the cost of refining heavy crude and risen demand for lighter products like gasoline.

According to U.S. Energy Information Administration (EIA) data, Canada exports around 4.3 MMbbl/d to the United States, whereas until last year demand to ship crude on export pipelines increased capacity, leaving barrels bottlenecked in Hardisty.

In 2018, the discount on WCS in Hardisty blew out to more than $40 a barrel, prompting the Alberta government to restrict output. Meanwhile, now there is sufficient pipeline capacity and WCS trades at approximately the same level as comparable crudes like Mexico's Maya. Canadian producers get that value, minus the spot pipeline tariff to the U.S. Gulf Coast, which is roughly $10 a barrel.

The EIA forecasts that Canadian production will increase 200,000 bbl/d by the end of 2022. Unfortunately, that could trigger bottlenecks to re-emerge until the Trans Mountain pipeline expansion to Canada's Pacific coast is completed in 2023, adding 600,000 bbl/d of capacity.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Growing Export of US Crude Oil Is Expected to Set Record This Quarter

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/80Blog_Top_Gulf_Coast_Crude_Terminals_2022_07.png)

On 27 June, the analysts at Kpler spread the word that the exports of crude oil from the U.S. Gulf Coast could break a record 3.3 MMbbl/d this quarter as Europe has regard to U.S. crude which can outweigh sanctioned Russian oil. Due to Washington's decision to release 180 MMbbl of oil from the nation's Strategic Petroleum Reserve, U.S. exports have increased in the last three months, as it has flooded the domestic market. Exports to Europe are anticipated averaging approximately 1.4 MMbbl/d this quarter, about 30% higher than the year-ago quarter, meanwhile, export to Asia is set to decrease to less than 1 MMbbl/d. Despite that the U.S. has lost about 1 MMbbl/d of refining capacity since 2020, it also boosted exports thanks to the government’s intervention to back crude supplies which has had consequences in growth in exports. Throughput via the Port of Corpus Christi has grown by more than 150,000 bbl/d and has become 1.86 MMbbl/d. Nevertheless, Port of Houston exports also have been increasing since the third quarter of last year, they remain below pre-pandemic levels.

Crude Pipelines Infrastructure Developing at Enbridge Ingleside Energy Center

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/63Blog_Enbridge_Ingleside_Energy_Center_pipelines_2022.png)

The joint project to improve and market a low-carbon hydrogen and ammonia production and export facility was presented on May, 6 by Enbridge Inc. and Humble Midstream LLC. Deployment of the facility is taken under the Enbridge Ingleside Energy Center (EIEC) basis close by Corpus Christi. Being the premier export facility on the U.S. Gulf Coast, the EIEC plays a vital role in world energy security and sustainability. Companies plan to develop a utility-scale efficiently low carbon production facility, able to combine both low-carbon hydrogen and ammonia to meet the growing global and domestic demand. It is expected to sequester up to 95% of CO2 generated in the production process in carbon capture facilities, especially ones owned and operated by Enbridge which makes this process a fully integrated low-carbon solution.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?