Comprehensive Energy Data Intelligence

Information About Energy Companies, Their Assets, Market Deals, Industry Documents and More...

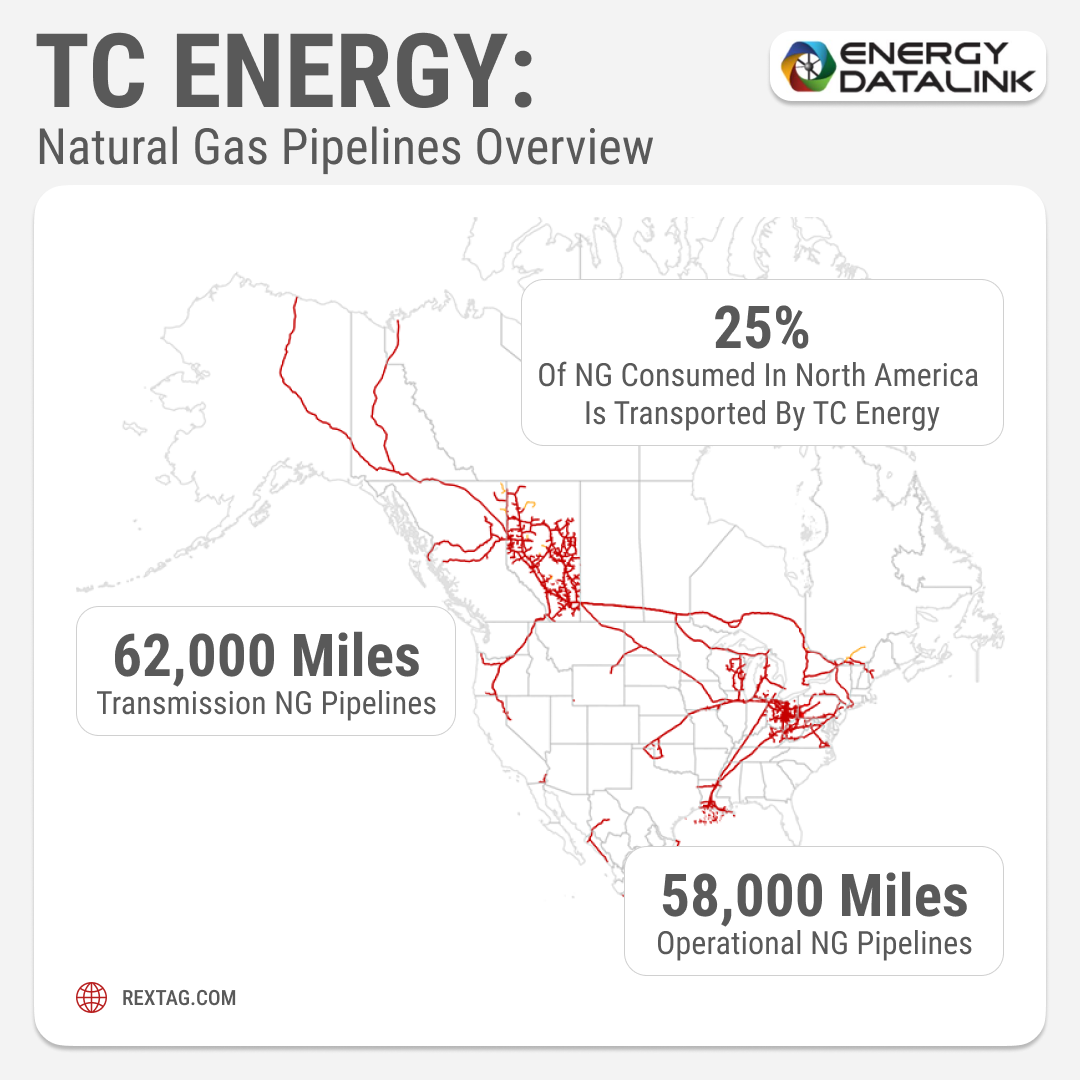

TC Energy sells 40% Stake in Columbia Gas Pipeline Systems for $3.9 Billion to GIP

08/08/2023

Calgary-based pipeline operator TC Energy is selling a 40% stake in its natural gas pipeline systems for $3.9 billion as part of its efforts to reduce debt.

TC Energy Corporation (TRP) has agreed to sell a 40% stake in its Columbia Gas Transmission and Columbia Gulf Transmission systems to Global Infrastructure Partners (GIP). This move will help TC Energy reduce its debt and establish a valuable long-term partnership with GIP, a prominent infrastructure investor.

Background of the Deal

The decision by TC Energy Corporation (TRP) to sell a portion of its ownership in the Columbia Gas and Columbia Gulf pipelines is driven by its long-term plan to raise capital and decrease its debt burden. The decision aligns with TRP's strategy of pursuing new investment opportunities and bolstering its position in the ever-changing energy market.

Deal Details

- TRP sells a 40% stake in Columbia Gas Transmission and Columbia Gulf Transmission systems to GIP.

- GIP pays C$5.2 billion (US$3.9 billion) in cash for the 40% stake.

- Part of TRP's plan to raise capital, reduce debt, and focus on new investment opportunities in the energy market.

- Expected Closing Date: Fourth quarter of 2023.

- GIP's Responsibilities: GIP will handle 40% of the annual maintenance, modernization, and growth capital investments (around C$1.3 billion annually) for 3 years.

- TRP will continue to operate both pipeline systems in the joint venture, prioritizing safe operations and service reliability.

- Future Projects: Proceeds from the sale will fund investments, including the Coastal GasLink pipeline.

- Closure Date: Agreement with GIP expected to close by November, finalizing the partnership.

Strengthening the North American Natural Gas Network

The Columbia Gas and Columbia Gulf pipelines create an extensive natural gas infrastructure spanning over 15,000 miles across North America. They play a crucial role in meeting a significant portion of the daily U.S. natural gas demand and contribute around 20% of the country's liquefied natural gas export supply. Additionally, these pipelines are instrumental in facilitating the transition towards lower-emission energy sources. Their operations are guided by robust long-term natural gas fundamentals and a rate-regulated commercial framework.

Energy Transition

TC Energy and GIP are committed to supporting the move to sustainable energy sources as the global energy landscape evolves. They aim to promote essential natural gas projects, recognizing the ongoing significance of natural gas in this transition. The Columbia Gas and Columbia Gulf pipelines will play a vital role in connecting the largest and most cost-effective natural gas basin to key demand centers and export markets, contributing to cleaner energy solutions.

Future Agenda

With the funds from the sale, TC Energy can focus on important projects like the Coastal GasLink pipeline, which is crucial for Canada's energy infrastructure. By prioritizing debt reduction and smart capital allocation, TC Energy aims to achieve sustainable growth and maintain its leadership in the energy sector.

The agreement between TC Energy and GIP is a significant milestone in the energy industry. It opens up new investment possibilities while ensuring top-notch operations for their core assets. The joint venture aligns with the broader goal of supporting the energy transition and highlights the enduring importance of natural gas in shaping a sustainable energy future.

If you are looking for more information about energy companies, their assets, and energy deals, please, contact our sales office mapping@hartenergy.com, Tel. 619-349-4970 or SCHEDULE A DEMO to learn how Rextag can help you leverage energy data for your business.

Warren Buffett’s Berkshire Hathaway Energy Acquires $3.3 Billion Stake in LNG Terminal

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/164Blog_Berkshire Hathaway Energy Acquires $3.3 Billion Stake in LNG Terminal.png)

One of Warren Buffett's Berkshire Hathaway subsidiaries is set to raise its ownership in the Cove Point liquefied natural gas (LNG) export terminal located in Maryland. This comes after the company signed a substantial $3.3 billion agreement with Dominion Energy. Under the agreement, Dominion Energy has agreed to sell its 50 percent noncontrolling limited partner interest in Cove Point LNG to Berkshire Hathaway Energy. Berkshire Hathaway Energy is the current operator of the facility and already holds a 100 percent general partner interest and a 25 percent limited partner interest.

ExxonMobil Acquires Denbury and Enhances carbon, capture, and storage efforts

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/165Blog_ExxonMobil Acquires Denbury in 5 Billion Deal.png)

ExxonMobil's joined assets speed up their Low Carbon Solutions business, offering better decarbonization options for customers. ExxonMobil's top CCS network supports their commitment to low carbon value chains, like hydrogen and biofuels. The transaction synergies will cut over 100 MTA of emissions, leading to strong growth and returns. Exxon Mobil Corporation revealed that it will acquire Denbury Inc., a company specializing in carbon capture, utilization, and storage (CCS) solutions and enhanced oil recovery. $4.9 billion deal will be completed through an all-stock transaction. Darren Woods, Chairman and CEO said “Acquiring Denbury reflects our determination to profitably grow our Low Carbon Solutions business by serving a range of hard-to-decarbonize industries with a comprehensive carbon capture and sequestration offering”.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/328_Blog_Why Are Oil Giants Backing Away from Green Energy Exxon Mobil, BP, Shell and more .jpg)

As world leaders gather at the COP29 climate summit, a surprising trend is emerging: some of the biggest oil companies are scaling back their renewable energy efforts. Why? The answer is simple—profits. Fossil fuels deliver higher returns than renewables, reshaping priorities across the energy industry.

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/327_Blog_Oil Market Outlook A Year of Growth but Slower Than Before.jpg)

The global oil market is full of potential but also fraught with challenges. Demand and production are climbing to impressive levels, yet prices remain surprisingly low. What’s driving these mixed signals, and what role does the U.S. play?

![$data['article']['post_image_alt']](https://images2.rextag.com/public/blog/326_Blog_USA Estimated Annual Rail CO2 Emissions 2035.jpg)

Shell overturned a landmark court order demanding it cut emissions by nearly half. Is this a victory for Big Oil or just a delay in the climate accountability movement?